Although both tariffs and quotas are tools used to restrict or reduce trade, which of the statements best describes their differences? a.) Tariffs are a subsidy for exported goods, and quotas act as a minimum limit of exports. b.) Tariffs are a tax on imported goods, and quotas are limits on the number of imported goods. c.) Tariffs are a tax on exported goods, and quotas are limits on the

SOLVED: Q1. How does the revenue effect of an import quota differ from that of a tariff? Q2. In the past two decades, non-tariff trade barriers have gained in importance as protectionist

A quota is a limit placed upon the amount of a good that can be imported. Consider Figure 15.6, where again there is a domestic supply curve coupled with a world price of P. Rather than imposing a tariff, the government imposes a quota that restricts imports to a physical amount denoted by the distance quota on the quantity axis. The supply

Source Image: intrepidsourcing.com

Download Image

Although both tariffs and quotas are tools used to restrict or reduce trade, which of the statements best describes their differences? Tariffs are a subsidy for exported goods, and quotas act as a minimum limit of exports. Tariffs are a tax on exported goods, and quotas are limits on the number of exported goods.

Source Image: coursehero.com

Download Image

ogspot.com www.GOALias.blogspot.com Jul 17, 2023A quota is more protective of the domestic import-competing industry in the face of import volume increases. A tariff is more protective in the face of import volume decreases. Exercise 7.15.1 7.15. 1. Draw a diagram depicting a small importing country with a nonprohibitive import tariff ( T T) in place.

Source Image: asiantradecentre.org

Download Image

Although Both Tariffs And Quotas Are Tools

Jul 17, 2023A quota is more protective of the domestic import-competing industry in the face of import volume increases. A tariff is more protective in the face of import volume decreases. Exercise 7.15.1 7.15. 1. Draw a diagram depicting a small importing country with a nonprohibitive import tariff ( T T) in place. The primary difference between tariff and quota is that the tariff is a tax charged on imported goods while quota is a limit defined by the government on the quantity of goods produced in the foreign country and sold domestically. … Although there are some similarities, like they both acts as a tool that seeks to control the international

Enforcement in Free Trade Agreements — Asian Trade Centre

Social Science Economics International Economics Chapter 5 – International Trade Although both tariffs and quotas tool used to restrict or reduce trade, which of the statements bets describes their differences? a) Quotas are a tax on imported goods, and tariffs are a tax on imported goods. 2.pdf – Although both tariffs and quotas are tools used to restrict or reduce trade which of the statements best describes their | Course Hero

Source Image: coursehero.com

Download Image

IB Economics HL Paper 2 Question Bank | TYCHR Social Science Economics International Economics Chapter 5 – International Trade Although both tariffs and quotas tool used to restrict or reduce trade, which of the statements bets describes their differences? a) Quotas are a tax on imported goods, and tariffs are a tax on imported goods.

Source Image: tychr.com

Download Image

SOLVED: Q1. How does the revenue effect of an import quota differ from that of a tariff? Q2. In the past two decades, non-tariff trade barriers have gained in importance as protectionist Although both tariffs and quotas are tools used to restrict or reduce trade, which of the statements best describes their differences? a.) Tariffs are a subsidy for exported goods, and quotas act as a minimum limit of exports. b.) Tariffs are a tax on imported goods, and quotas are limits on the number of imported goods. c.) Tariffs are a tax on exported goods, and quotas are limits on the

Source Image: numerade.com

Download Image

ogspot.com www.GOALias.blogspot.com Although both tariffs and quotas are tools used to restrict or reduce trade, which of the statements best describes their differences? Tariffs are a subsidy for exported goods, and quotas act as a minimum limit of exports. Tariffs are a tax on exported goods, and quotas are limits on the number of exported goods.

Source Image: yumpu.com

Download Image

Chandan Sapkota’s blog: Jul 22, 2009 Business. Operations Management. Operations Management questions and answers. although both tariffs and quotas are tools used to restrict or reduce trade, which statement best describes their differences.

Source Image: sapkotac.blogspot.com

Download Image

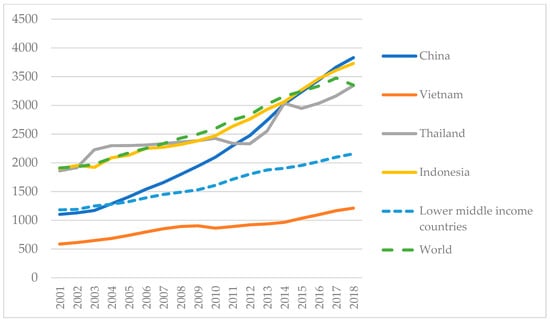

Economies | Free Full-Text | Declining Protection for Vietnamese Agriculture under Trade Liberalization: Evidence from an Input–Output Analysis Jul 17, 2023A quota is more protective of the domestic import-competing industry in the face of import volume increases. A tariff is more protective in the face of import volume decreases. Exercise 7.15.1 7.15. 1. Draw a diagram depicting a small importing country with a nonprohibitive import tariff ( T T) in place.

Source Image: mdpi.com

Download Image

Advancing agricultural trade reforms: Latin American contributions to the multilateral trading system | IFPRI : International Food Policy Research Institute The primary difference between tariff and quota is that the tariff is a tax charged on imported goods while quota is a limit defined by the government on the quantity of goods produced in the foreign country and sold domestically. … Although there are some similarities, like they both acts as a tool that seeks to control the international

Source Image: ifpri.org

Download Image

IB Economics HL Paper 2 Question Bank | TYCHR

Advancing agricultural trade reforms: Latin American contributions to the multilateral trading system | IFPRI : International Food Policy Research Institute A quota is a limit placed upon the amount of a good that can be imported. Consider Figure 15.6, where again there is a domestic supply curve coupled with a world price of P. Rather than imposing a tariff, the government imposes a quota that restricts imports to a physical amount denoted by the distance quota on the quantity axis. The supply

ogspot.com www.GOALias.blogspot.com Economies | Free Full-Text | Declining Protection for Vietnamese Agriculture under Trade Liberalization: Evidence from an Input–Output Analysis Business. Operations Management. Operations Management questions and answers. although both tariffs and quotas are tools used to restrict or reduce trade, which statement best describes their differences.